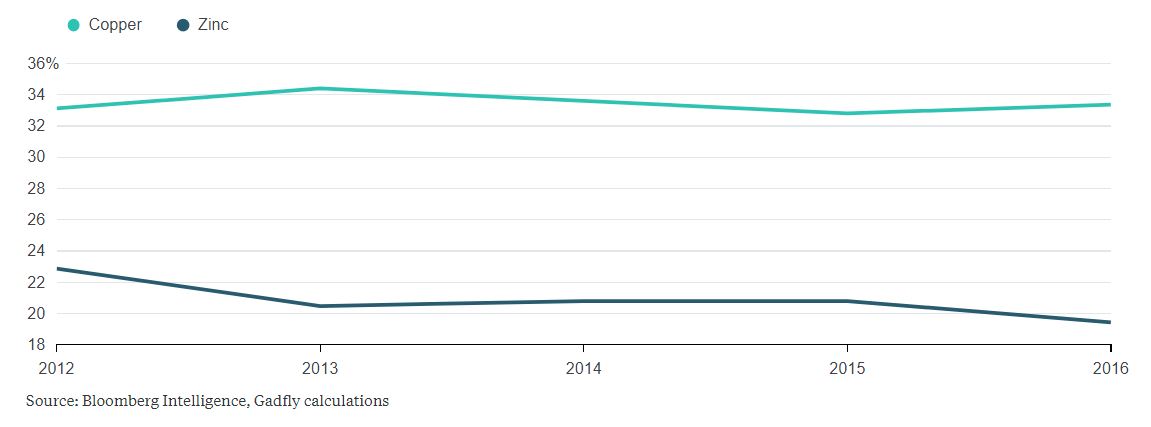

Whereas the top three producers of copper account for more than a third of global mined output, the figure comes to less than a fifth for zinc. That lack of concentration means producers have little scope to influence the market, leaving them at the mercy of price movements.

Control Experiment

The market share of the top-three miners of zinc is well below that for copper

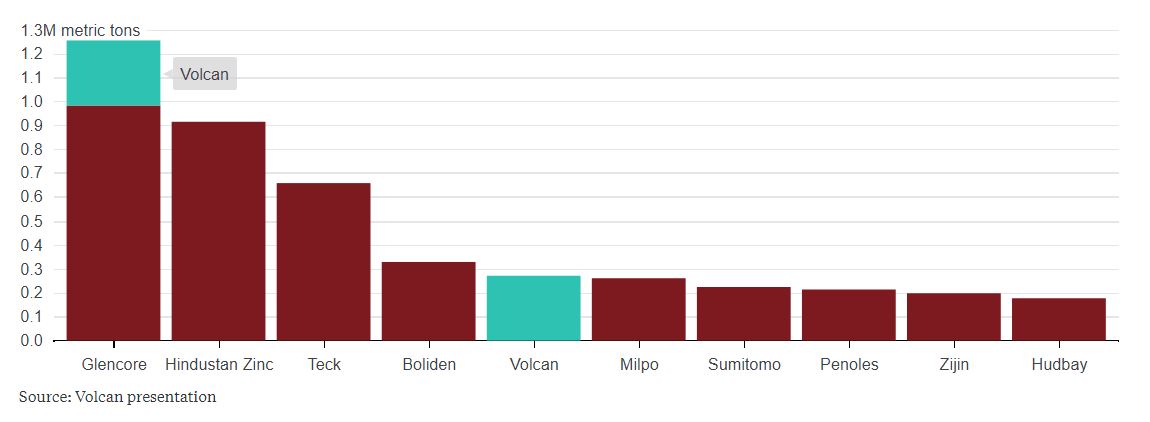

With an offer of as much as $956 million that could see Glencore Plc take control of Peru's Volcan Cia. Minera SAA, Chief Executive Officer Ivan Glasenberg seems determined to change that.Volcan is currently the world's fifth-biggest zinc miner, with output forecast at 265,000 metric tons to 275,000 tons this year. Add Glencore's planned and mothballed production and throw in guidance for Hindustan Zinc Ltd. and Teck Resources Ltd., and you're just a whisker away from a 25 percent market share, well on the path to a more rational state of affairs.

Room at the Top

Adding Volcan's production to Glencore's will entrench the position of the top three zinc producers

That assumes all other producers stand still, of course. As Gadfly has argued before, this doesn't look like being the case. High commodity prices have a way of encouraging miners to pump up production, from smelter Nyrstar NV to MMG Ltd., which will shortly open the 170,000-ton-a-year Dugald River mine to replace its defunct Century pit.

For all that it's trying to exert more control in zinc, Glencore is unlikely to run into the sort of antitrust issues that scuppered BHP Billiton Ltd.'s attempts to merge its iron ore operations with Rio Tinto Group's. Were it to incorporate Volcan's output with its own current-year forecast of 1.13 million metric tons, and add back the 500,000 metric tons of potential production that's currently being held back, Glencore would still command less than 14 percent of the market.

The bigger risk is that commodities take a turn from their current benign outlook. Volcan's operating costs are low, but Glencore's are negative at present, thanks to other elements that occur as a by-product in zinc ores and that collectively are worth more than the costs of production. The fact that Glencore is committing close to $1 billion on increasing its output via a takeover, rather than just restarting its own idled assets, is an indication Glasenberg remains unconvinced the market is strong enough to sustain the increase in production that he could, in theory, trigger any day.

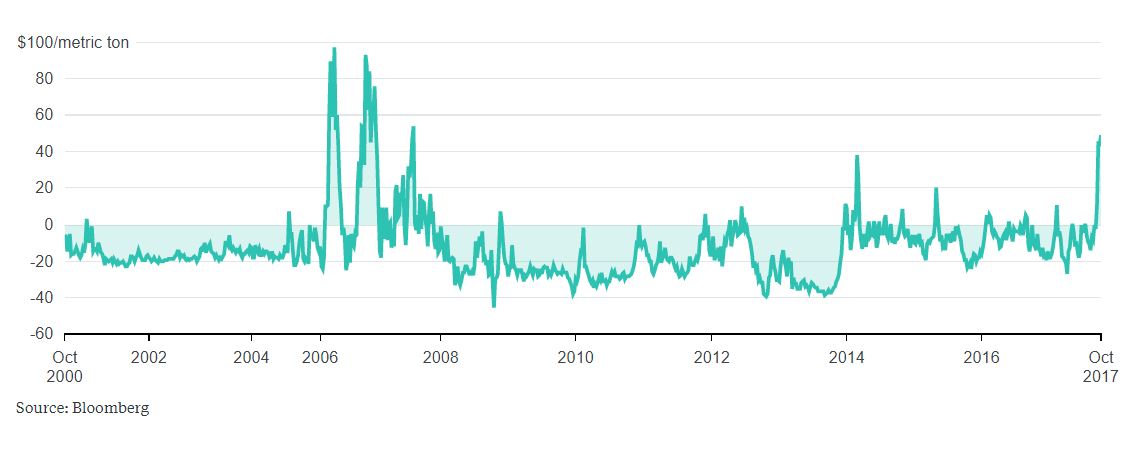

Nonetheless, for the moment zinc is shining bright. China's hunger for metal shows little sign of flagging: The arbitrage between Shanghai and London contracts, which historically has rarely broken through 600 yuan ($90) a metric ton, is only just returning to those levels after almost three months of gaping even wider open. Prices are at their highest in a decade, and the premium that buyers on the London Metal Exchange are prepared to pay for immediate delivery has surged to $49.50, reversing a typical contango in the forward curve.

She's Gotta Have It

The premium that zinc buyers are prepared to pay for spot metal over three-month forwards is at its highest level in a decade

Glencore is happy to make hay while the sun shines on zinc prices. Should clouds gather, however, its move to consolidate the market through control of Volcan's pits represents a smart insurance policy.Peter Grauer, the chairman of Bloomberg LP, is a senior independent non-executive director at Glencore.