A global iron ore supply crisis after a dam burst at Vale’s mines in Brazil on January 25 has meant good business for pellet producers.

Demand has shifted for Indian-origin pellets as uncertainty grows about supplies from Vale, the world’s top iron ore producer. “Indian pellets are in huge demand in China and Vietnam. Exports to the two countries are growing post-supply disruptions by Vale. At a time when demand for lower grade iron ore is fragile, the opening up of pellet export markets has buoyed exports from India”, an industry source said.

Vale suspended mining at Corrego do Feijao after the dam breach, triggering a 13 per cent spike in iron ore futures at the Dalian exchange in China. The company announced on January 29 the decommissioning of all its upstream tailing dams over the next three years, meaning a production shortage of 40 million tonnes a year. Moreover, a court in Brazil, as a measure of safety, ordered the suspension of Vale’s operations at Brucutu mines, creating a deficit of 30 million tonnes.

Production losses from Vale’s mines spooked iron ore markets and prices surged to $92, the highest since 2014. There are forecasts by both Citgroup Inc and Commonwealth Bank of Australia that prices might ascend to $100 per tonne.

Inflated prices and continuation in supply crisis of iron ore are likely to firm up pellet exports from India. A report by Icra Research sees pellet exports at 8.9 million tonnes in this fiscal and climbing to 12.5 million tonnes in FY 20.

Brightening prospects of pellets, an intermediate product in steel making at the export markets has brought a bout of relief for the distressed producers who are wrestling with thinning demand in the domestic market. According to Pellet Manufacturers Association of India (PMAI), the domestic demand for iron ore pellets has come down significantly because downstream steel and DRI plants prefer to use iron ore lumps with its price correcting in the past few months.

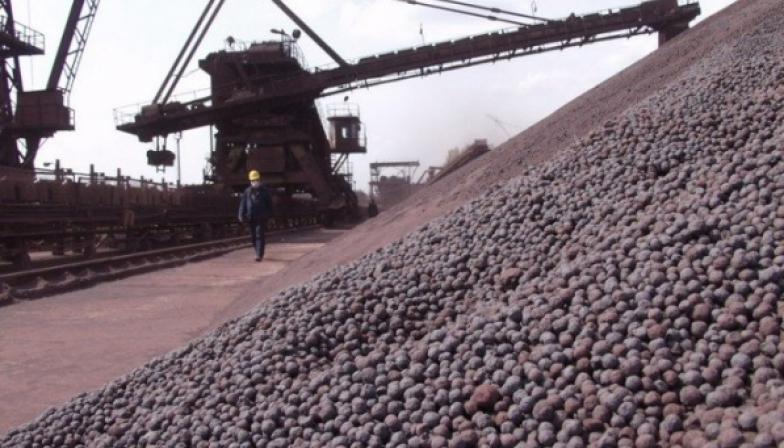

India has a pellet manufacturing capacity of 85 million tonnes per annum. But only 70 per cent of this nameplate capacity was utilised in FY18 when production stood at 59.6 million tonnes. A large chunk of this domestic output was used within the country and 15 per cent was shipped for export markets.

Despite operating below the rated capacity, pellet plants have helped in domestic value addition to 68.5 million tonnes of iron ore fines. Pelletisation of the lower grade fines resulted in Rs 2513 crore collection by way of royalty, District Mineral Foundation (DMF) and National Mineral Exploration Trust (NMET). The domestic pellet industry helped realize foreign exchange of $984 million, assuming an average export price of $110 per tonne of pellet in FY18.