The best-selling iron ore futures contract on the Dalian Commodity Exchange, with delivery in May 2020, rose 3.2% to 662 yuan ($ 94.05) per tonne in the morning auction, the largest since August 7. It jumped 2.96% to 661 yuan per tonne.

Prices for spot cargoes of 62% standard iron ore for delivery to China also tracked a stable futures market and rose to $ 93 per tonne on Monday from $ 89.50 in the previous session.

"The rise in iron ore prices was mainly caused by concerns about foreign mining companies' deliveries in the first quarter of next year," said Tan Bingqing, an analyst at CIFCO Futures, citing the fact that Brazilian miner Vale SA is reducing production prospects and approaching production deadline. rent in india.

Meanwhile, the outlook for demand for metallurgical products and steelmaking has improved since the last conference of the Chinese Communist Party reaffirmed the need to strengthen infrastructure and did not mention real estate control issues, Tang added.

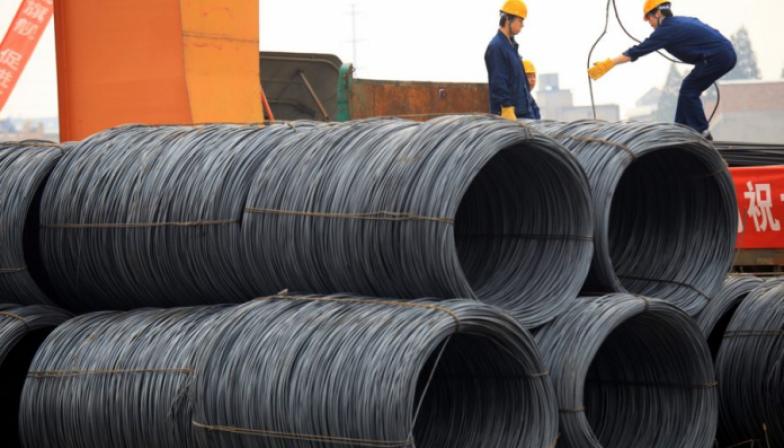

Steel reinforcement at the Shanghai Futures Exchange with delivery in May 2020 jumped 1.0% to 3528 yuan per tonne.

The January contract for hot-rolled rolling stock used in cars and household appliances grew 0.7% to 3690 yuan per tonne.

The basics of growth

Futures for Shanghai stainless steel with delivery in February 2020 rose by 0.2% to 14,010 yuan per tonne. Other steelmaking ingredients were on the Dalian Exchange, such as coking coal shipped in January 2020, down 0.3% to 1,243 yuan per tonne, while Dalian coke rose 1.2% to 1928 yuan per tonne.

According to data released on Tuesday, Chinese producer prices dropped for the fifth consecutive month on Tuesday, while consumer prices rose sharply as food prices rose, hampering policymakers' efforts to boost demand amid slowing economic growth.

($ 1 = 7.0389 Chinese Yuan)