The Great Squeeze: 5 Reasons Tungsten Carbide Prices Surged in 2025

If your business relies on tungsten carbide for cutting tools, mining equipment, or industrial components, you’ve felt the pinch this year. 2025 has been a landmark year for the market, marked by a significant and sustained price increase that has impacted supply chains globally.

This isn't a minor fluctuation; it's a fundamental market shift. In this analysis, we'll break down the five key drivers behind the 2025 tungsten carbide price surge and what it means for your operations moving forward.

Understanding the Baseline: What is Tungsten Carbide?

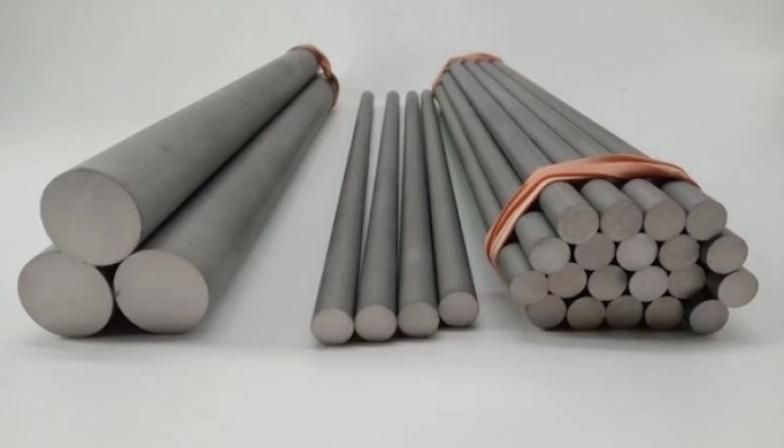

Before we dive into the "why," let's quickly recap the "what." Tungsten carbide is a composite material known for its exceptional hardness, wear resistance, and high melting point. It's the backbone of countless industrial applications, including:

-

Metalworking: CNC inserts, end mills, drills

-

Mining: Drill bits, picks, and wear parts

-

Construction: Tunneling equipment and abrasives

-

Aerospace & Defense: Critical components and armor

Its production is heavily dependent on tungsten ore (wolframite and scheelite), a strategic resource where China dominates the global supply chain.

The 5 Key Drivers of the 2025 Price Increase

1. Geopolitical Tensions and Supply Chain Fragility

The situation in key resource-producing regions has remained tense throughout 2025. China, which controls an estimated 80% of the world's tungsten supply, has continued to implement strict export quotas and domestic stockpiling policies. These measures, framed around national security and environmental goals, have constricted the global flow of raw tungsten ore, creating a supply bottleneck that has driven up costs from the very source. You can find many china carbide manufacturer.

2. Soaring Energy Costs in Manufacturing

Tungsten carbide production is incredibly energy-intensive. The process of reducing tungsten ore to powder and subsequent sintering in furnaces requires massive amounts of electricity. The volatile global energy market in 2025, with high natural gas and coal prices, has directly translated into higher manufacturing overhead for carbide producers worldwide. These costs are inevitably passed down the supply chain.

3. The Green Tech Boom: Unexpected Demand

The explosive growth of the electric vehicle (EV) and renewable energy sectors has created a new, powerful source of demand. Tungsten carbide is crucial for manufacturing components like lithium-ion battery electrodes and the cutting tools used to machine lightweight alloys for EVs. This "green demand" has placed additional pressure on the already tight market, competing directly with traditional industrial sectors.

4. Persistent Inflation and Logistics Costs

While inflation has cooled from its peak, 2025 has not seen a full return to pre-pandemic logistics costs. High shipping fees, port congestion in certain regions, and general inflationary pressure on labor and raw materials like cobalt (a common binder for tungsten carbide) have all contributed to the final price tag.

5. Consolidation and Strategic Stockpiling

In response to market uncertainty, major industrial consumers and governments have engaged in strategic stockpiling. This "just-in-case" inventory building removes significant volumes of material from the open market, further exacerbating the shortage and giving producers more pricing power.

What Does This Mean for Your Business?

The era of consistently low tungsten carbide prices is likely over. Businesses must adapt to a new normal characterized by:

-

Higher Operational Costs: Budgets for tooling and wear parts need to be reassessed.

-

Longer Lead Times: Supply constraints may lead to delayed deliveries.

-

Increased Importance of Supplier Relationships: Partnering with reliable, transparent suppliers is more critical than ever.

Navigating the New Market: 3 Strategies for 2025 and Beyond

-

Embrace Tool Management Programs: Implement tool tracking and recycling programs. Used tungsten carbide scrap has significant value, and a robust recycling strategy can offset some of your new material costs.

-

Evaluate Alternatives and Efficiency: Work with your engineering team to see if alternative materials or grades can be used for non-critical applications. Focus on optimizing tool life and machining parameters to get the most out of every insert.

-

Diversify Your Supply Chain: Don't rely on a single source. Explore suppliers outside of traditional hubs and consider those who are transparent about their raw material sourcing and energy strategies.

The Bottom Line

The 2025 tungsten carbide price surge is a complex issue rooted in geopolitics, energy, and powerful new market demands. By understanding these root causes, businesses can move from reactive frustration to proactive strategy, ensuring they remain competitive and resilient in a challenging industrial landscape.

Stay informed and stay ahead. The market is dynamic, and staying updated on these global trends is your first line of defense.